Why Are We Still Surprised?

Last week, news broke about BluSmart and Gensol allegedly inflating invoices and fudging books. There was collective outrage. Headlines. Hot takes. Disbelief.

Really?

Because I’m not surprised. And neither should you be.

We’ve seen this film before.

BharatPe. GoMechanic. Housing.com. The costumes change. The con remains.

But what if the issue isn’t a few bad apples?

What if the whole orchard is rotten?

What if Indian business is no longer just about profit, but about performance?

Not building companies, but building optics?

Not value creation, but value extraction?

Over the past few weeks, I’ve been writing a 3-part series exploring why Indian business behaves the way it does. It’s part lament, part diagnosis, and part solution. A cultural autopsy, if you will.

This series is for anyone who’s ever wondered why good ideas collapse.

Why honesty is punished.

Why cheating is a celebrated skillset.

And what, if anything, we can do about it.

Spoiler: it’s not about better enforcement.

It’s about better culture.

Not because I have the answers.

But because we’ve run out of excuses.

P.S.: Throughout the series, I have used the masculine “he” to denote the Indian businessman (I refuse to call him an “entrepreneur”). And for good reason. For more often than not, it is a “he”. Let’s not, for the sake of political correctness, make it sound as if we have so many women entrepreneurs that we need to use “they”. There’s still time to go for that. A lot more time.

⸻

Part 1: The Problem – Why Indian Businesses Are Like This.

Mera import export ka business hai.

That one line, uttered with slicked-back hair, a faint Dubai accent, and a gold chain around the wrist, was once Bollywood shorthand for everything wrong with the economy. Smuggling. Black money. The villain in a suit and sunglasses who caressed a Pomeranian and never paid tax.

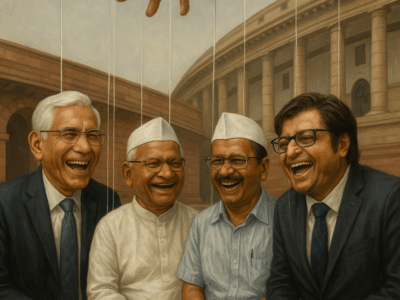

Today, that same man is giving TEDx talks. In jeans and black polo.

He’s building an EV startup.

He’s raising a Series B.

He’s posting about sustainability, diversity, and the metaverse.

And he’s still not playing by the rules.

Only the vocabulary has changed. And perhaps the accent.

Let’s not pretend to be shocked by BluSmart, Gensol, GoMechanic, BharatPe, or whichever house of cards falls next. This is not an anomaly. This is the operating system of Indian business. The average Indian entrepreneur is not a misunderstood visionary with cashflow issues. More often than not, he’s a glorified trader with Canva, ChatGPT, and an MBA.

Let’s be clear about the game:

Buy low. Sell high. Withhold information. Add nothing. Extract everything. Repeat.

The motto is simple: Put. One. Over.

Put one over whom?

The customer.

The vendor.

The employee.

The taxman.

The auditor.

The regulator.

The investor.

The whole ecosystem is a target-rich environment. Every relationship is a transaction. Every transaction, a contest. Every contest, a zero-sum game.

And this isn’t just about money.

Three great forces drive him:

Greed, because he wants more than the next person.

Fear, because he worries someone else might get there first.

And adrenaline, because cheating the system has become a thrill in itself.

Indian businesses begin with greed. Pass through fear. And then evolve into adrenaline. It doesn’t stay about profits. It becomes about performance. The rush. The story. The game. It’s not the gain that excites. It’s the con.

Why else would educated founders risk everything and raise hundreds of crores only to inflate revenue, cook books, and pilfer money?

This is no longer business.

This is theatre.

Accounts are fiction.

Contracts are suggestions.

LoIs are orders.

Auditors are props.

Compliance is cosplay.

Due diligence is a parlour trick.

ESOPs are candy floss.

And somewhere in all this, the very idea of building something real has vanished. There is no long-term. No stakeholder capitalism. Only exit. Flip. Flee.

Even those who want to play fair are often forced to play dirty. The system punishes integrity. Pay full tax? Lose the tender. Pay staff fairly? Get undercut. Follow the rules? Get outpaced.

This isn’t just a few bad apples.

This is the orchard.

And we have not just tolerated this. We have celebrated it. We have built temples to hustle, altars to jugaad, and shrines to the operator who always finds a loophole. We have turned cheating into a virtue.

So no, I’m not surprised.

And neither should you be.

Because this isn’t a flaw in the system.

This is the system.

⸻

Part 2: The Roots – Where This Came From.

Let’s play a dangerous game.

Let’s assume the Indian businessman is not born corrupt.

Let’s assume he is made.

Now the question is: who made him?

Colonialism did. But not just the British.

Before the East India Company opened its account, the Mughals were already here, practising a different kind of capitalism. State-backed, quota-driven, favour-based. Business in India ran through mansabdars and jagirdars, through bribes, fiefdoms, and quiet skimming.

The Mughal state didn’t encourage enterprise. It demanded revenue. It didn’t build trust. It demanded tribute. It didn’t empower the merchant. It exploited him.

So the merchant adapted.

He learned to hide.

To under-report.

To bribe the collector.

To grease the officer.

To survive.

Then came the British, who turned extraction into policy.

Where the Mughals taxed produce, the Company taxed existence.

Where the Mughals skimmed surplus, the British dismantled systems.

They turned India from a nation of producers into one of providers. Of cotton, cheap labour, and unending taxes. The weavers of Murshidabad, the shipbuilders of Bombay, the artisans of Lucknow. They weren’t outcompeted. They were crushed.

Their crime?

They were too good.

Too skilled.

Too Indian.

So the British did what colonisers do best. Monopolised production. Controlled trade. Penalised excellence. Business wasn’t just discouraged. It was criminalised unless it served the Crown.

And the businessman adapted again.

He hoarded.

He lied.

He smuggled.

He bartered.

He learnt to put one over. Not as strategy, but as self-defence.

That’s the point.

Putting one over wasn’t a thrill.

It was a shield.

A way to survive a hostile state.

To protect what was his.

Then came 1947.

We thought we had won freedom. What we got was Licence Raj.

A brown sahib in place of a white one.

Form in place of form.

Quota in place of quota.

The bureaucrat replaced the British officer. The dance stayed the same.

Paperwork, palm-greasing, permissions.

Rules designed to be broken.

A system that rewarded opacity.

If you wanted to do business, you had two options. Cheat, or shut shop.

So once again, the businessman adapted.

He became a fixer. A trader. A conjurer.

He built empires on access, not value.

Knowing whom to call, and when.

And slowly, this stopped being a hack.

It became heritage.

The son watched the father “manage” the inspector.

The father watched the grandfather “settle” the case.

And thus was born the Indian business family. Not built on transparency or accountability, but on one mantra:

Play the system.

Or the system will play you.

And now, in 2025, we wonder why founders lie.

Why books are cooked, vendors stiffed, taxes dodged, and revenue invented.

This isn’t a new virus. It’s muscle memory.

Centuries of conditioning.

When the state has always been your enemy, and trust a liability, cheating is not deviance.

It is instinct.

This didn’t start with BharatPe.

This started with Bengal.

⸻

Part 3: The Solution – What Now?

Let’s say we accept the truth.

That Indian business has become a theatre of hustle.

That cheating is not the exception. It is the culture.

That the system rewards manipulation.

That the orchard is rotten, not just the apples.

Now what?

What do we do when a generation believes bending rules is not just normal, but necessary?

We start with one uncomfortable truth:

You cannot punish your way out of a cultural problem.

You cannot jail every evader.

You cannot audit every lie.

You cannot enforce ethics at gunpoint.

For every rule, there’s a workaround.

For every fine, a bribe.

For every law, a loophole.

This must be solved at the level of belief.

Of incentives.

Of identity.

Not compliance.

Culture.

1. Government: Make Honesty Easier than Dishonesty

Simplify. Digitise. Demystify.

Make tax filing a 5-minute job. Ideally, use AI and the data the government already has on you to file tax, allowing the individual or corporate to modify in case it missed something.

Track licences in real time. And trasparently. Allow everyone to see.

Use tech to remove middlemen, brokers, and “setting”.

Make opacity impossible. Not illegal. Impossible.

Reward good behaviour.

Celebrate honest businesses. Give them perks. Not certticates. Actual, usable perks. In cash. Or kind. Keep the process of awarding these transparent. Use technology to increase transparency and reduce opacity. Everywhere.

Let integrity come with benefits, not just pain.

2. Education: Teach Capitalism, Not Just Commerce

MBA programmes don’t teach ethics. They teach arbitrage.

Start in school. Teach what a stakeholder is.

That value is not just what you extract, but what you create.

To build, not hustle. To contribute, not outsmart.

Put ethics in the syllabus.

Because ethics is not genetic. It is taught. Or not.

3. Business Media: Stop Glorifying the Grifters

We made celebrities out of conmen.

Turned fundraisers into thought leaders.

Put valuation above value. Exits above endurance.

Time to stop.

We need new heroes. Not unicorns. Camels.

Founders who bootstrap. Build slowly. Pay taxes.

Not those who sell dreams. Those who stay awake and deliver.

4. Society: Stop Applauding Jugaad

When your neighbour saves tax, don’t nod.

When your uncle wins tenders via contacts, don’t say “smart move”.

When your friend fakes compliance, don’t laugh.

Every time we cheer the cheat, we bury the builder.

This doesn’t need protests.

It needs corrections.

At dinner tables. In boardrooms. On WhatsApp.

It needs us.

5. The System: Protect the Good Apples

The honest businessman is endangered.

He pays staff. Follows the law. Doesn’t fudge books.

And gets punished for it.

Margins lower. Approvals slower. Competitors faster.

He cannot survive without protection.

So protect him.

Prioritise clean books in procurement.

Create green channels for ethical businesses.

Faster clearances. Better rates. Easier access.

Level the field by lifting the straight.

If we don’t fix this, we’ll build nothing.

No lasting companies.

No trusted institutions.

No legacy.

We will keep raising money and losing face.

Launching, collapsing.

Pretending, posting, pitching.

Until we realise we never built a business.

We only ran a con.

At scale.

And that will be our true national loss.

Not a scam.

A squandered century.