A lot of people are saying a lot of things involving a lot of jargon and complicated words to justify their opinion of this. Frankly, it needs a bit of simplification. So, here it is, using, as usual, an analogy:

A lot of people are saying a lot of things involving a lot of jargon and complicated words to justify their opinion of this. Frankly, it needs a bit of simplification. So, here it is, using, as usual, an analogy:

- Imagine you have an asset that you have built, say a house on which you have spent say, Rs.40,00,000, from which you are deriving rental income of say, Rs.10,000 per month (rentals yields are usually 2-4% of value in the Indian residential market, and so this is a realistic figure).

- Imagine now that you are in a cash crunch and need liquidity urgently, say Rs.12,00,000, which is equivalent to roughly 120 months of rental income at the same rate. But the problem is that you need all of it now.

- One way to get this is to approach a bank, value your house, mortgage that house and get a percentage of the value (typically 50%), which would be Rs.20,00,000. Then, you pay a small interest on that for the next decade, or two.

- Another way is you offer the rental to a financier (which could be a bank, a moneylender, an NBFC, a friend, HNI, whoever). That means that you claim that this tenant of yours is a stable paymaster and that rent would not be delayed or missed and that you have an agreement for a significant period, say 120 months from today, and rent would go up by 10% per annum on the previous year’s base, meaning that in 120 months, the total rental income earned would be Rs.19,12,490.95, and that you would like that money upfront for forfeiting the right to collect any rent for the next 10 years, which shall then be collected by the lender. Of course, you will not get it all. The way the lender would factor in five things:

- The risk of the tenant defaulting or something similar happening that would cut off or reduce the income;

- The opportunity costs, meaning where else that investment could have earned more money and the loss of such an income;

- The value of the property, the currency, and the lease in real terms, not just now but over the next 10 years;

- Other market and environmental factors, including the liquidity of this investment as well as the real estate market in general and so on; and

- The quantum of profit they are going to make on the deal.

- Obviously, this is a complicated calculation and while there are several models that accountants and economists (by no means the same people) use to arrive at what the Net Present Value (NPV) of the asset (which could be the fixed asset like your home or the liquidity which is the future rental income, against which they are going to give you money is, suffice to say that they will discount the cash flow (the periodic income to them, viz., the rent) by a certain percentage and offer you only what seems worth the risk and the returns they expect. That means that by definition, you would get far less than what you would earn if you did not need the entire rental income over the next 10 years discounted and handed over to you right now. But you are happy because you need the money now.

- Let us now turn to why you may need that money and what is a reasonable justification to discount your rent or mortgage your home to pick up a large cheque immediately. There are only two reasons why you may need that liquidity in such a hurry:

- You messed up your budgets and now find yourself in a hole with expenditure already incurred and no money left for it.

- You can see another investment opportunity that will fetch you far better yields than the 2-4% you are getting, and even while factoring in for the lower amount you will receive in hand (given that it would be discounted), you will end up making a killing on this new investment of yours.

- It is easy to see why reason number 1 is a bad justification and reason number 2 is a reasonable one. In the first one, you are leveraging your previous hard work (which went into building that asset) to support an unjustified habit, like an extravagant lifestyle or addictive substances. In the second one, you are borrowing against future income to invest into a parallel future where you see far more gains, at least enough to offset the risks of losing the amount of money deducted in the discounting.

- So, mortgaging your home for playing the lottery or marrying your offspring off in an ostentatious affair is a bad idea, while doing the same to invest into your startup or the higher education of your child is probably far more reasonable. Because one is an expenditure, and the other, investment.

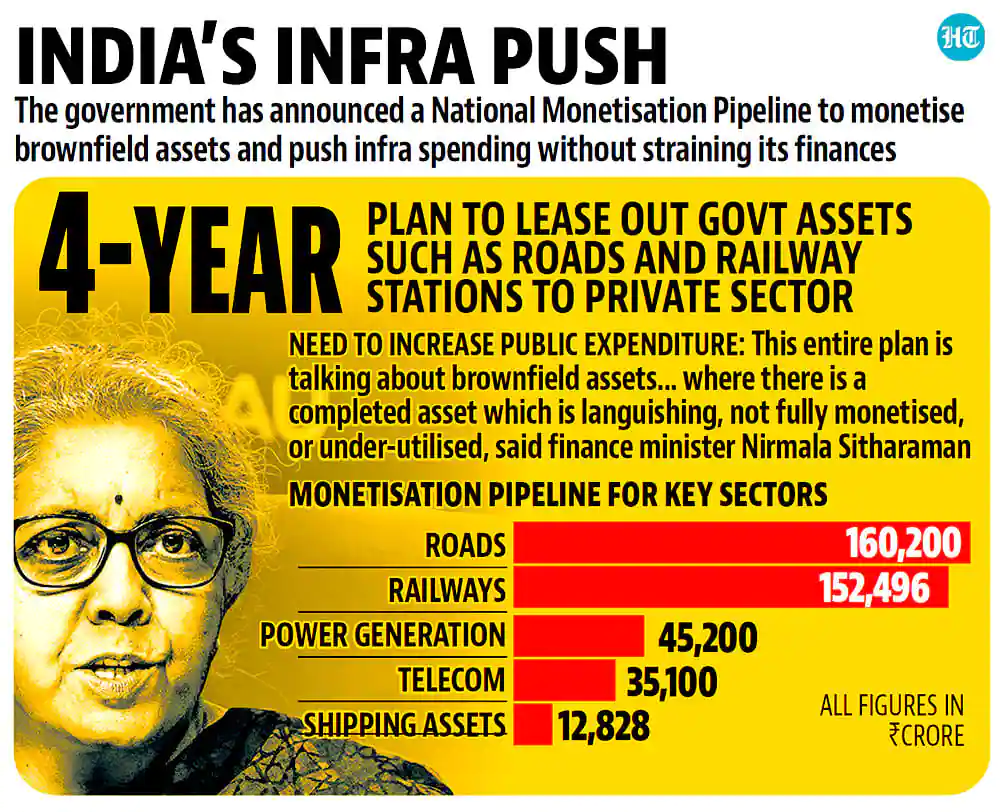

The question we need to ask, therefore, of our government, is not whether the asset monetisation program is good or bad, for there can be no objectively moral or immoral way of justifying it. After all, as one side will argue, it is an asset, we paid for it, it has value to be unlocked, and there is money on the table. So, why not? Sure, I say. All I want to know, of course, is what are you going to do with that money. Are you going to be playing roulette with it or are you going to use it to invest in the future?

And by the way, in case you are wondering where in this particular analogy, we the people stand in this game between the government, who technically owns the assets, and the various financiers who will bid for them, after discounting the cash flows, here’s the kicker: We, that is you and me and a billion-plus people like us, are the tenants. We don’t pay less rent either way and all the cash flows on which both these parties are negotiating are coming from our pockets. The only difference between this analogy and today’s reality is that we also paid for building that house!