A well-known investor on LinkedIn asked:

Double standards in the startup ecosystem. Why is it considered acceptable for an entrepreneur to start a startup in order to earn lots of money, but when an angel investor funds a startup, he is considered to be greedy and mercenary?

I think the answer is as simple as one wants to make it (people without money tend to look at people with money with a jaundiced eye) or as complex as one cares (with references running from Adam Smith to Marx, from anti-Semitism to the genesis of the Joint Stock Company, and from Nehruvian socialism to Manmohanomics). The truth lies somewhere in between, and is full of shades of grey (or the colours of a rainbow, depending on what analogy you prefer). And that truth is that this kind of complaining is equivalent to the ‘Dalits speaking of millennia of oppression are being casteist.’ argument. It misses reality by a few light-years, reverses the actual victim-perpetrator dynamic, and casts the privileged, oppressive, bully as the injured party, when the truth is diametrically opposed to such a fatuous claim. In Hindi, such a claim is rightfully characterised as, ‘उलटा चोर कोतवाल को डाँटे।’

Of course, this post is more about the entire private financing industry as such and not specific to Angels (since I quote one right at the beginning), and of course, I have my own opinion and my own perspective of why this perception exists. But while the question is specific, I believe the cause lies in something far more general and wide-ranging in nature. The roots of the problem are somewhere else, even though the query limits itself to the colour of the leaves in a certain season. (Is it too early to use the woods-trees analogy?)

As an entrepreneur of 29 years, with about as many startups behind me, I think I have a unique angle to this, and I wish to explain it in this article.

Do you remember the movies from the immediate post-independence era? Mother India, for example. These movies (including “Mother India”) reflected the perceptions of Indian society at the time. An unlettered farmer was considered a hard worker while the educated moneylender was considered a greedy villain because physical labour was seen as more virtuous and deserving of more reward than financial risk.

That mentality continues today, and while to some extent, it is a perception problem, there is rarely smoke without fire. VCs and other private financiers have indeed used their clout and money to create an unequal playing field for the startup founders in India today. So, while accepting that it (the “Mother India” analogy) is not always true, the reality is that this perception didn’t come out of thin air, but has more than a touch of reality to it.

To understand it, let’s go back to the analogy (while keeping in mind that analogies only serve as aids to understanding and not as exact models for any scenario they describe): Prima facie the farmer was seen as sweating in the sun, skipping meals, living in a hovel, making ends meet only with great difficulty, dreaming impossible dreams of leading a comfortable life for him and his family, and basically physically working much harder than the moneylender while the moneylender was seen using his education, exposure to the world, privilege, caste, network, and of course, wealth, to create a coterie with other moneylenders, landowners, royalty & people in power, and wealthy & powerful people to oppress and cheat the farmer. This was done partly by giving out an impression to the farmer that he and his family (usually seen as a large one, with many children, portraying a certain profligacy and wastefulness as against the single child of the moneylender/zamindar, signifying a kind of frugality and rectitude, just like the startup founders of today are looked down upon for what the investor thinks are wasteful expenditures) had no option but to come to the moneylender if he wanted to simply survive in his plough-sow-water-reap-sell cycle, especially in droughts and floods, in times of hospitalisation and weddings, for building a hut or buying a bullock.

And because the moneylenders operated in a cartel and had the knowledge the farmer lacked (simply because such education was the moneylender’s bread & butter, without which he could not function professionally, while the farmer had little or no use of it in his daily work), they could decide interest rates, mortgage requirements, repayment periods, etc. They could even create complex financial structures that rewarded them more than the farmers, and keep it couched in jargon which they claimed was simple, convenient, and universal (it wasn’t) by cooking up books and complicated repayment plans, by buying and selling debt, by manipulating the prices of the very commodity the farmer was growing, either by hoarding it or working with his competition even while lending money to both. They could collaborate with other moneylenders to shut out the farmer from the system in case of a default. They could use the courts and the legal framework, which they understood better than the farmer (that was, after all, their livelihood, not the farmer’s). In effect, there was an imbalance of information, knowledge, and hence, power, which gave the moneylender the upper hand in almost every case.

When asked, the moneylenders always replied that the farmer was more than welcome to learn more of their trade (accounting, debt structuring, book-keeping, etc.), even if he had no time, no money, and no use of such knowledge except to keep himself secure from the very people who were mocking his lack of knowledge, and using it to fleece him. It was like a Gabbar Singh (there you go, another analogy!) asking the farmers and cobblers and ironsmiths of Ramgarh to learn how to shoot if they wanted to be saved from him, from a problem he had created in the first place! ‘No one has stopped them from learning,’ Gabbar would claim. ‘It’s just a life skill they ought to know, given that they live in such a remote village surrounded by dangerous dacoits’ (himself!).

Of course, the moneylenders always thought that they were being rewarded for their (significant, according to them) risk, just as the farmer was being rewarded for his (cheap and abundantly available, according to the moneylenders) sweat. The ‘I am risking my money, and that’s a bigger deal than the farmer risking his life’ argument was always presented as more righteous by the moneylender. Of course, by the end of the film, the farmer won, the moneylender lost, and the public went home happy thinking that somehow it reflected real life. It didn’t. Not then, not now.

Even to this date, this is the same argument that today’s private financiers and VCs make vis-à-vis their attitude, investments, and expectations from startup founders. Even to this date, they claim it’s just free markets operating freely as St Adam Smith predicted and dictated they should.

But it is only on close inspection and in the harsh light of reality that one sees the flaws in them. For the Utopian perfect free market to function, there must be no imbalances in the access or flow of information to all parties. That is not practically possible. The founder-investor ecosystem (much like the yesteryears’ farmer-moneylender relationship) is skewed in favour of the person with the money, political muscle, access to networks, privilege of birth, the contacts that flow through that privilege, and the alma maters that result from it, all of which are so incestuous in nature that they move only within a closed circle, much like their money, and have traditionally never ventured out of it.

In fact, such is the charmed closed circle of investors in India and so small is it that we founders (in my group) claim they could all fit in an Innova, with room to spare. Of course, we are exaggerating, but an ‘Innovaful of Deplorables’ is too juicy a hashtag to let pass!

To the limited question asked by the specific individual investor on LinkedIn, I hope that is a satisfactory explanation of the various prejudices we see when perceived from the founders’ side. And, to be honest, I am glad that investors (especially the one who asked this, since I have tremendous respect for this man) have started asking such questions, hopefully with an intent to understand entrepreneurs better (and not with any malicious agenda). Let us hope for a new era of more understanding, more empathy, and better partnerships, leading to better and more equitable creation of value and wealth.

Now, having said that, let us dive deeper into this question of what ails the venture capital and startup private financing industry in India.

A great place to start would be to see if we can spot any trends in who has gotten funded in recent times. Perhaps, we can tease out some answers from our experience, data, and recent history.

As starters, I would challenge you to take a look at the last 1,000 days’ or just over 3 years’ data (available on Crunchbase, Traxcn, and other similar databases/websites) of people and companies getting funded in India and here’s what you will most likely find: None or a rare Bahujan/Dalit. None or a rare Muslim or member of traditionally poor minority communities. None or a rare woman. None or a rare North Easterner (from any of the 7 NE states). None or a rare non-ivy leaguer. No transgender or openly gay person. Mostly Savarnas (Indian high-castes). A disproportionate number of IITs and IIMs and ISBs. Many ex-MNC career employees. Many business family scions. Many with family wealth and generations of business behind them. Most having a house and a car. Almost all of them heterosexual cis-gendered men. You get the point.

Does that mean Dalits, women, Muslims, people who went to Municipal schools, people who went to the local community colleges, people whose parents are uneducated, people who come from villages, people who live in huts and slums, people who are retired, people who live in the NE, people with alternate sexualities, and others like them do not innovate, or only create worthless products/services, or do not have ideas, or cannot work hard, or do not take risks, or are less likely to succeed, or cannot manage companies, or cannot add value to the society, or are incapable of creating huge wealth, and are generally unfundable? I am sure you’d disagree.

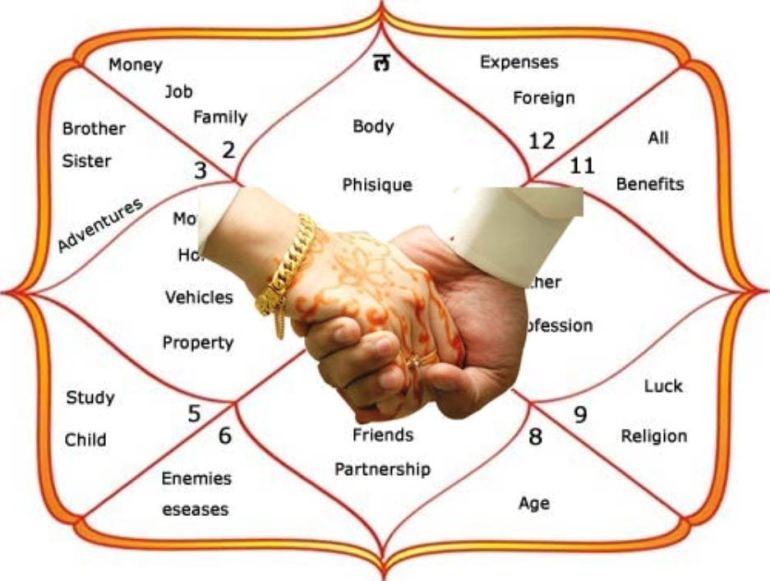

Mathing 36 gunas?

Then, why is it so? There are several reasons, chief amongst which is that most VCs are urban (in fact, mainly metropolitan), Savarna, ivy-league educated, ex-MNC, heterosexual, cis-gendered men from the more developed parts of the country, in short: Privileged Indian Males. Now, it is well-known in psychology that we are attracted to people who look like us. It extends to people who have gone through similar life experiences as us and hold similar beliefs. For example, I could far more easily connect to someone who speaks the same language as me, was brought up in the same town as me, went to the same/similar school as me, etc than someone who differs in these respects. Surely, there are 1,000s of such parameters (or, according to Jyotish-Shastra, actually 36 gunas, but let us not bring woo and superstition into the picture here and keep it real), and it would seem that the more of these that match between people, the quicker they begin to like each other.

‘Hamein matlab nahi chahiye, Masterji. Hum yaad kar lengi.’

What has that got to do with VCs funding startups? A lot, it would seem. The one thing that is critical between an investor and a founder is trust. And that is naturally built quicker, deeper, and stronger with “People Like Us” or PLUs, which is shorthand for those who have gone through similar life experiences as us and have similar backgrounds, follow similar lifestyles, come from a similar genetic pool, and share our basic philosophies and beliefs in life. Naturally, in a professional environment, it boils down to your university (alma mater), your last or recent job, your current city, your accent, whether your spouse or partner is also a PLU, whether your parents are, and in a more profound way, your gender, your caste, your hairstyle, your choice of clothes, the kind of music you love, the pace with which you pick up on social clues and cultural references, or the specific brew of coffee or beer you prefer.

It. All. Adds. Up. Pretty. Quickly.

Now, let us come to the kind of businesses that get funded. Look at the same database of Indian startups over the past 3-odd years and you will find another interesting trend: Either you have very niche, high quality, internationally styled & branded products/services targeted at a small percentile of the population (normally, the well-to-do, well-educated, urban, English-speaking, metropolitan, internet-enabled, well-travelled, elite between 22 and 55) or you have poor quality, poorly built, poorly designed, but extremely cheap products and services targeted at the lower end of the class spectrum, with the assumption that cheap equals bad quality.

Also, the interesting part is the extremely low occurrence in these funded startups of any real innovation, except for in branding or naming their product or something superficial like packaging. The core business seems to be more or less straight lifts from the USA, EU, Australia, or nowadays, Japan and Korea. Sometimes, entire codes are stolen. Sometimes, entire concepts are taken in toto and are even called that (“Uber for X” or “Snapchat for India”). Sometimes, one word is inserted into the name of a foreign brand to make it “new” (or “Raw”, if you get the drift). Everything else remains the same, as with the original idea that was stolen.

Now, let us turn to the way VCs operate. Leaving aside those HNIs who use their own money to invest into startups, and which form a really small proportion of the total funds invested, we must understand that the money the VC invests into a startup does not belong to him (by the way, my constant use of the masculine gender for both the investor and the entrepreneur is deliberate, and reflects reality, unfortunate as it is). He is simply managing the fund for other partners who are investing the actual money. These are called LPs, or Limited Partners, who put in the funds, as opposed to the GPs, or General Partners who manage the investments and front the fund. The GPs are answerable to the LPs regarding their money.

Why is this important to know? Because that last sentence where I said that the GPs are answerable to the LPs, actually means that the GPs are responsible for explaining the losses! In other words, when you manage someone’s money, rarely are you asked to explain why you met or exceeded targets or the promises you made the investor. The only explanation you are asked, and are expected to have clear, believable, and defensible answers to, is about the money you lost or an investment that underperformed. That’s just human nature. And investors and VCs are, if anything, only human.

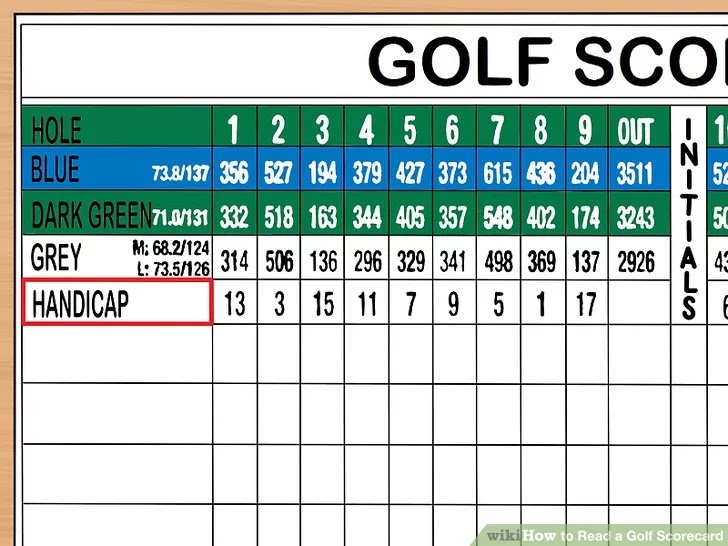

Also, there is another statistic that one needs to understand about the VCs and their investments. And that is that only 1 out of 20 companies they invest into go on to become blockbuster hits. 3 more out of the same 20 become middling successes, and the rest 16 fail miserably. You’d probably not find this statistic quoted in any research paper, but this is what any VC worth his salt will tell you in private. In fact, I have it in writing from a VC in a mail that they only need to be right 20% of the time! That’s the same odds of me playing to my exact honest handicap in golf (once in five rounds) and beating it by 3 or more strokes (once in twenty). That isn’t exactly winning a lottery, and therein lies another problem. The problem is that you have to perform to a bar that is set (artificially, I will argue in this article) so low that the limited pool of entrepreneurs and ideas that the VC has to select from suffices to meet his targets comfortably without putting in too much effort. In golf, we call such people frauds (or sandbaggers).

So, we have a unique situation. Imagine yourself a VC:

- The people you instantly like and trust seem to be young(-ish) like you, Savarna (high-caste) like you, male like you, educated in IIT/IIM/BITS/ISB/Columbia/Michigan/Wharton/Yale etc like you, having worked with Google/Microsoft/ITC/HUL/GE etc. like you, English-speaking with an accent like yours, married or partnered with people like you are/were married/partnered with, and come from backgrounds that are similar to yours. In fact, they probably use similar jokes, cultural references, and jargon you are comfortable with. They are PLUs. You trust them intrinsically and intuitively.

- They bring to you ideas that you are comfortable with because you have seen (and used) these products/services when you were yourself abroad and have always wondered why we don’t have such things in India. Some of the ideas are literally ones you and your neighbours would love to buy/use/pay for/subscribe to, if only it were available. Some also bring you ideas that you think your maid or your driver or your Nepali or UPite security guard would buy into if offered on the cheap. You realise that they wouldn’t really be getting the best of what can be offered, but it’s better than nothing, and at some obscene volumes, there are margins to be made and profits to be booked, along with the halo you could flaunt for creating “impact” or “returning to the society” some vague debt you owe. The fact is that any PLU is incapable of bringing you an idea that you yourself couldn’t have thought of. They are incapable of solving any problem outside the experience, imagination, and training of a PLU. They are naturally limited in what they see as problems worth resolving. And hence, you end up with ideas that are not out of the box. Far from it. They can never be.

- You only have to be right 20% of the time. But when you go back to your LPs, you need to explain the other 80% investment and justify your investments into them. Now, think: What are the chances you will invest into something that you cannot justify in case of a failure (which is likely to occur 80% of the time)? There used to be a saying in the early days of computers, “No one got fired for buying IBM” meaning that if someone bet on the standard, the run-of-the-mill, the non-controversial, the straight-and-narrow, even if it failed, no one would get blamed for it. It applies equally today to Indian VCs. They’d rather risk failure than go before their LPs with bets they cannot justify. The result of such risk-averse thinking (even if subconsciously) is that they end up backing people who are well-qualified on paper, regardless of what half-assed copy-cat ideas that serve small niches they bring or what apparently “radical” bottom-of-the-pyramid “impact” or “socially responsible” cheap-hence-low-quality products/services they champion.

You can see how this specific set of circumstances results in the kind of investments into the kinds of people and ideas that have been made in India over the recent past.

What this does is not only keep a large swathe of potentially dynamic entrepreneurs powering the economy by solving larger problems, coming up with innovative ideas and imaginative solutions, and generating huge value and wealth for a larger number of people, but also harms the VC and his LPs by (a) limiting the net they cast and hence, the value they create for themselves, and (b) increasing their chances for more than a 5-20% chance of a large bet paying off.

But there might be another reason for this, and that is where I put on my ‘conspiracy hat’ (in a way). It is quite possible that the VC community has an insidious interest and a perverse incentive to keep their hit rates artificially small so that the standard bar for performance is set so low as to not require them to get their asses out of their fancy leather chairs in their fancy Mumbai and Bengaluru offices to actually go to the real India looking actively for entrepreneurs who are capable of changing the world, but for the money they need, which the VCs have in plenty, if only they were to reallocate their funds from the fancy niche copy-cat ideas brought to them by privileged boys from their circles and put them into some (no, cross that – a lot of) real solutions with a real chance of winning.

So, then there is a solution, then? I don’t know. What I do know is that there’s a huge unmet opportunity hiding in plain sight, but for what the investor circle has to get out of their own echo chambers, get out of their comfort zone (or should I say, jerk circle?) and go and cast their nets wider. Find the real Indians with real solutions to real problems, and bet on them, big. Some bets will fail, that’s natural. And it won’t happen overnight. But if there’s a chance of success, of a change in the way they operate, and even from a purely capitalist point of view, in the value (and wealth) they create not only for their partners and shareholders, but also for all stakeholders and if I may be so forward, for humanity itself, then that chance must be taken, nay seized with both hands, and followed to wherever it may lead.

Indian entrepreneurship can only come of age if the right kind of risk investment is made available to people outside the charmed circle, to women and minorities, to the Bahujans and Dalits, to the college drop-outs and Municipal school pass outs, to transgenders and older folks, to the rural and the semi-urban innovators. They are out there. You just have to look.

An Innovaful of Deplorables.

And where does one start? Right at the VCs’ offices, in fact. Hire for diversity. Hire imaginatively. Hire wide, and not just deep. And empower these diverse people to go find people like themselves. The same forces that worked before will work their magic as these diverse scouts shall bring in innovative ideas from PLUs, except that the PLUs in this case would be better distributed along the demographics. Once the ‘Innovaful of Deplorables’ expands to a ‘Trainful of Adventurers’, the effect of this inclusiveness will be evident in the value they bring, and create together.

Trainful of Adventurers.

It’s a simple change with huge payoffs. And it costs you nothing more than what you are already losing in your bad bets.

One last analogy before I sign off: In the 2015 Ajay Devgn movie, “Apaharan”, the anti-hero hero, Ajay Shastri (played by Devgn) declares (and I paraphrase very loosely here, not remembering the exact line), “पॉलिटिक्स करने के लिए न पैसा लगता है, न ताक़त। पॉलिटिक्स करने के लिए सिर्फ़ गुर्दा लगता है, गुर्दा!” Of course, this is an exaggeration for dramatic effect. But there is a seed of truth in this. Does anyone in this community have the गुर्दा to change? That, my friends, is the US$5 trillion question.

Note: A large part of this article was written in late 2018, and was revised, added to, and modified once in February 2019, once in August 2019, and then published in November 2019 here, after appearing on various other social media at other times in 2018 and 2019.

Thanks for sharing. Absolutely spot on analysis.

VCs are free to do what they want as long as it is legal. My only gripe about this system is that in a capital starved country like India, feeding flop shows like Shopclues and AskMeBazaar with a few thousand crores is killing the possibility of using the capital more productively, say to build a factory that manufactures something, rather than dump the chinese crap at throwaway prices. There is no profession in the world where you just need to be right 20% of the time- even politicians are better. And most VCs have never built anything in India- a Harvard degree that's paid for by your parents and a stint at McKinsey makes you eligible to manage and deploy billions.